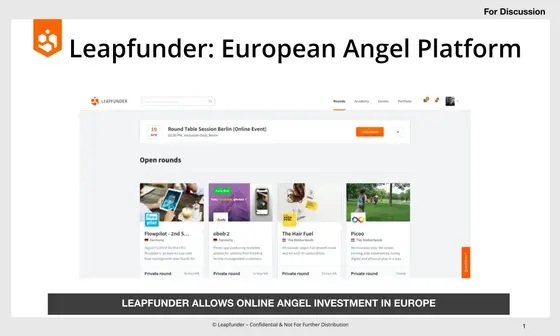

Europe's leading

Angel Platform

Straightforward angel investing in startups.

Interested in becoming an investor?

Book a free call with one of our experts

170+

Rounds funded

€30k-800k

Avg.Round size

~25,7%

Avg. Return p.a.

Invest in startups

What we have to offer

Leapfunder makes angel investing easy and convenient

Everything in one place

No time wasted handling legal paperwork, and plenty of deals available for you to choose.

Make a difference

Build a relationship with your startups, and add value from your experience and network.

Safe & Secure

Full secure payment environment, refund if the startup doesn't complete sufficient fundraising.

Leapfunder events

Pitch Deck Clinic (Online Workshop for Startup Founders)

Investor Readiness Session (Online Workshop for Startup Founders)

No time spent networking with startups outside of your interests, and no time wasted handling the paperwork.

Visit our Academy

Learn handling investment and funding and utilizing the platform of leapfunder to its full potential.

They invested via Leapfunder

" The Leapfunder Note is a sensible and attractive way to place capital in start-ups in the Netherlands "

" Diversification is important in angel investing. Leapfunder is a platform that allows angels to spread their investments. "

" Leapfunder investing allows you to become actively involved in a start-up, just as in classical angel investing, while taking all the hassle out of transaction execution "

" Leapfunder is ideal for investing smaller amounts in a start-up in the very early stages. Such investments can be a powerful addition to a portfolio "

" With Leapfunder you get a great opportunity to build up a diversified portfolio of start-up investments, often investors can play an active role in developing the company "

" When I saw the Leapfunder proposition I thought straight-away: this is what start-ups need. I am an entrepreneur and wish this system had been available when I started my company. "