What Our Platform Delivers

The Three Essentials

1.

Find Startups

2.

Network with Investors

3.

Invest

Explore many startups and

invest in your favorites

invest in your favorites

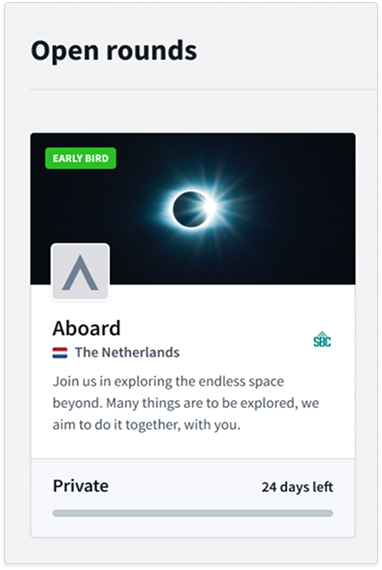

Easily discover many interesting funding rounds online

and request access to detailed investment information.

and request access to detailed investment information.

Check Out all the Features of Leapfunder

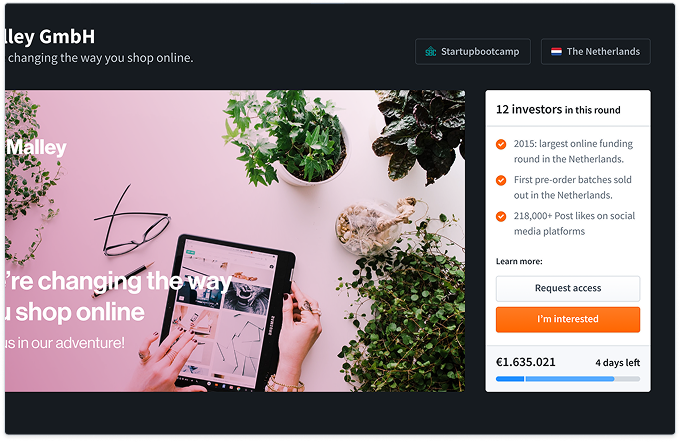

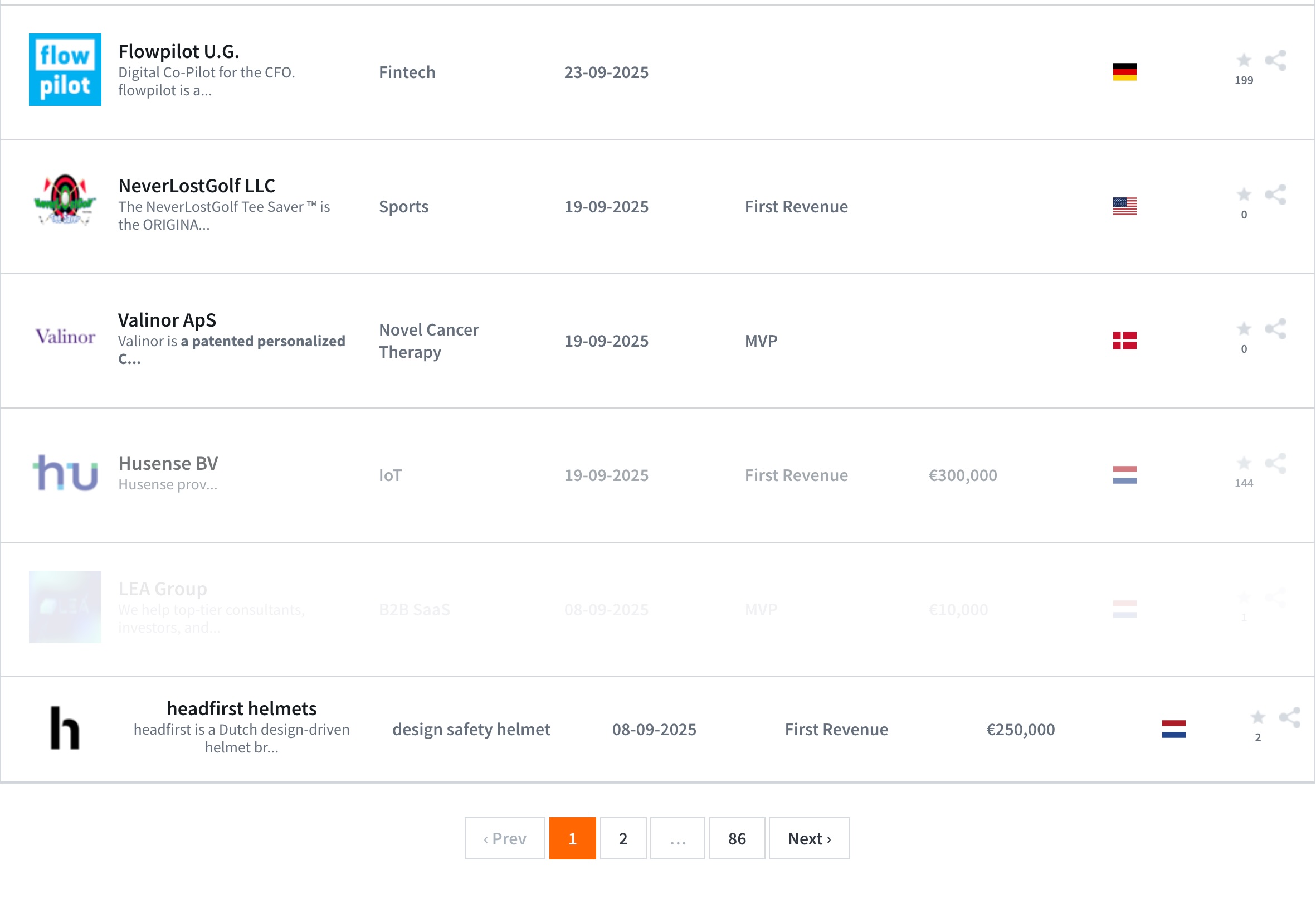

On our Rounds Page you will find an overview of all the startups that have open investment rounds. You can find a summary of the investment information on this page. If you want to proceed to the full data room: just press the request access button and the startup will admit you.

Our startup directory allows you to search through the records of every startup that has registered on Leapfunder. There are thousands of entries, and this dBase will give you a sense of what is going on in the broader market.

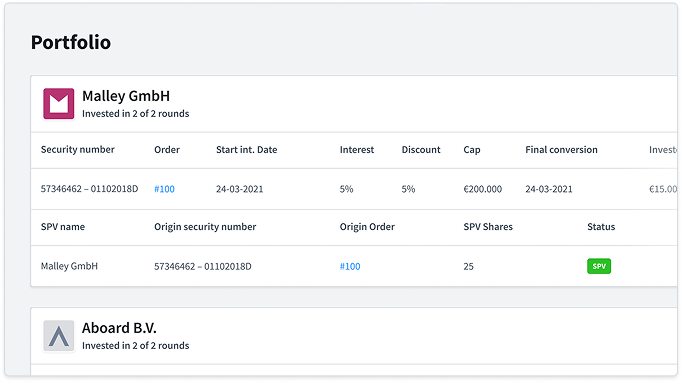

The portfolio page shows you the details of all your past investments. After a transaction you can always find all your investment and order details here.

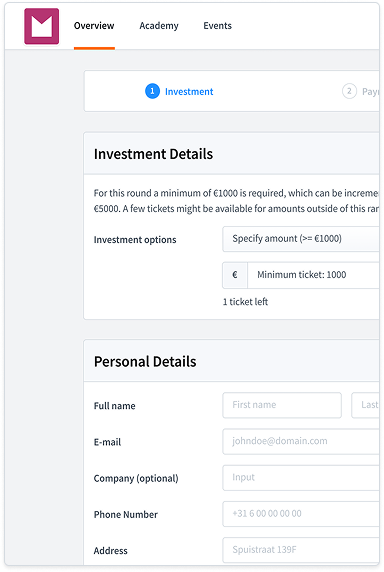

With Leapfunder you can fully complete an Angel investment online. The process is easy and safe, it is a bit similar to buying an airline ticket. The legal paperwork has been in use for years and has been constructed by some of the most experienced startups lawyers in each jurisdiction. From your second portfolio company you will pay a transaction fee to Leapfunder. This transaction fee is dependent on your subscription type, check inside your plans description for the details. Your first portfolio company is free.

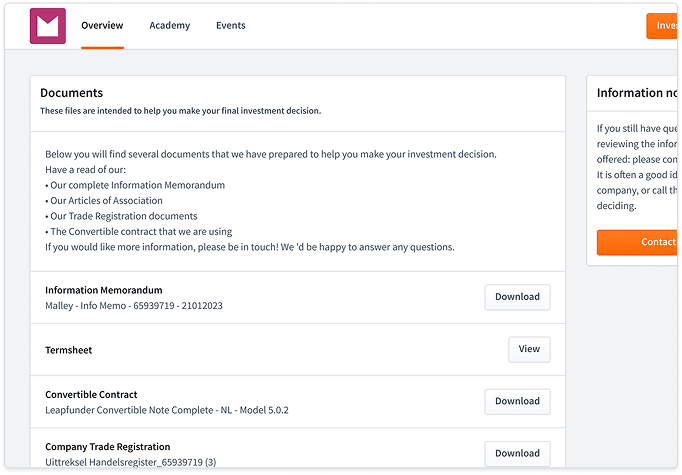

When you invest the master copies are stored by a chartered accountant. They will also email you a copy directly when your investment is completed. But in the Document Vault you will have all your investment documentation in one place. That means no searching in your email or setting up a cloud-storage. We have the information available for you.

You can always request access to the dataroom of a startup. In the dataroom you will find detailed information about the company, and the investment opportunity. After this you can contact the CEO, before making your final investment decision. When you have Direct Access enabled on your account you can even go into the dataroom directly and without waiting for the startup to admit you. That is a lot more convenient, and discrete.

Get involved by joining the startup's group chat with other investors. Our startups normally like WhatsApp. Founders can share wins, post updates and ask for advice. It can be quite helpful for all.

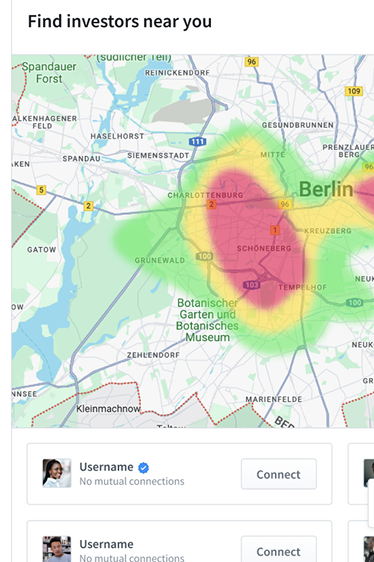

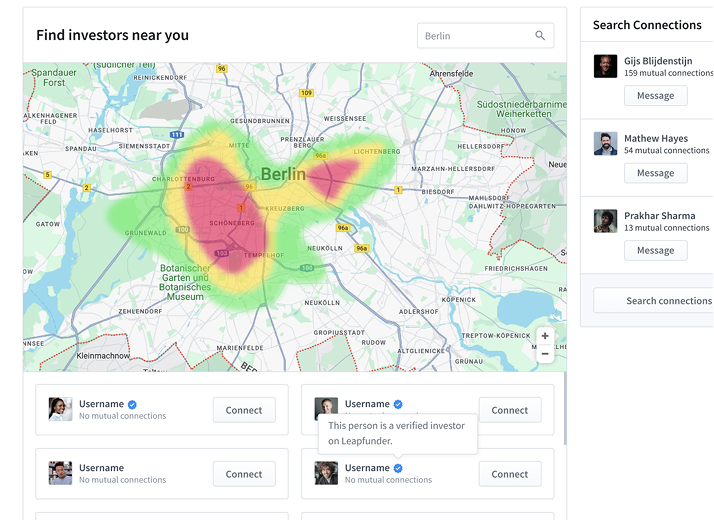

On our system you can find Angel investors with whom you have shared investments, or shared investment interests. We offer a secure way of starting a conversation with this one click. By connecting with other Angels you can build a network of regular co-investors, sparring partners, or just social contacts.

Search for active investors on an interactive geographical map. Perfect when you’re traveling or visiting another startup hub. You can discover local Angels, request intros, and line up a coffee in advance of your travel. There may well be more active investors than you think, near to where ever you are.

Get first access to startup datarooms, even before the round is open to all investors. With early access you can review details sooner and invest. Most startups give the first investors favorable financial terms, which will be there waiting for you.

As featured on: